The rapid development of technology has had massive impact on the financial services industry and has introduced new rounds of development.

The emergence of new technological opportunities have entailed the expansion of individual and institutional consumers’ demands in ensuring particularised financial service provision and their regulatory stipulation.

About Forty Seven Bank

Before we move on, it’s important to understand the context behind the formation of Forty Seven Bank

According to CoinMarketCap, there are nearly 1,000 crypto assets at the moment with a total market cap of over $200 billion. Experts suggest that the figure could easily cross the $1 trillion mark in 5 years.

Other than the increase in market cap, there is also the trend of moving away from centralized to decentralized markets, an idea suggested by the European Commission which obliges financial institutions to grant them access to their various products and services via APIS.

This integration will also help digital assets (especially cryptocurrencies) to establish itself in the financial world, hence bringing much-needed efficiency and transparency to the market.

However, the digital assets market is mostly unregulated with companies commonly facing problems like struggling to convert gathered funds into fiat currencies and then use them as capital as a digital asset is neither an equity nor liability for now.

Hence, Forty Seven Bank was built to overcome the problems of digital assets as well as increasing mass adoption by the public.

The platform also aims to become a modern universal bank both for users of cryptocurrencies and the traditional money system that is acknowledged by international financial organizations and corresponds to all the laws and regulations.

Forty Seven Bank will also become the biggest institution that corresponds to all the requirements of regulators and the EU Payment Services Directive 2 (PSD2).

The platform is 100% compliant as it follows Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in order to safeguard the security and privacy of users.

Forty Seven is based on three principles: relevance, convenience, and security. Our specialists use up-to-date technological developments such as blockchain, biometrics, smart contracts, machine learning and many others. If you are interested in the specific details of our establishment and creation of a hi-tech bank.

The Forty Seven project is founded on three key principles — Relevance, Convenience, and Security.

RELEVANCE

Forty Seven Bank incorporates and deploys the most up-to-date innovative technologies available, such as blockchain, biometrics, smart contracts, and machine learning. This allows Forty Seven Bank to bring all the services of traditional banking to users of cryptocurrency and bringing to users of traditional fiat currency all the benefits of disruptive new technologies.

CONVENIENCE

Forty Seven Bank introduces the concept of a ‘multi-asset account’ which gives customers access to and control of both crypto and fiat assets in one place, through one simple, easy to use interface. While the use of biometric identification and blockchain allows users ease of access and the capability to manage multi-asset accounts from anywhere in the world via smartphone, or ATM and without the need for a card.

SECURITY

Forty Seven Bank will be recognised by international financial organisations, and conform to all regulatory protocols and requirements, including the European Union’s Payment Services Directive 2 (PSD2). The bank will also be compliant with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, guarding against exposure to actors and representatives of the “grey” market. High-end encryption and biometric ID verification will be employed to protect and secure the integrity of customers personal and payment data.

Cryptocurrency and the technology driving it is changing the infrastructure, institutions, and processes of banking and will continue to do so over the coming decades. Forty Seven Bank is a bank tailor-made for this future, positioned to connect the crypto and fiat markets, unite them under one roof, and offer customers the best of both worlds with a bank designed for the digital age.

Mission of Forty Seven Bank

The mission of Forty Seven Bank and management team is to provide safe, innovative and user-friendly financial services and products to Forty Seven customers — individuals, businesses, developers, traders, financial and governmental institutions. Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibilities to level up the whole modern financial system.

Products and Services

1. Innovative products for everyone

The featured product is a Multi-Asset Account for private customers with a tied card.

- Remote identification and authorisation based on passport and biometric data

- Unique combination of payment tools — SWIFT, credit and debit cards, e-wallets, secured cryptocurrency payments

- Transactions with any type of cryptocurrency through the bank’s application and with no need to wait for current exchanges. Uploading, withdrawal, and conversion by any pair is available

- Wide range of services including crediting, insuring, invoice presentation, credit/debit card management etc.

- Cross-platform access for clients to manage accounts opened with any European bank that complies with the PSD2 directive

- Convenient and user-friendly UI

- Analysis that helps a client to make the right financial decisions via services of a personal manager created on the basis of machine learning algorithms

2. Propositions for business

Business products oriented towards small and medium-sized enterprises.

- Managing an account via Application Programming Interface (API), creation of financial applications

- Receiving payments from a merchant in both cryptocurrencies and in fiat money on the company’s account (card, SWIFT) using a form or API

- Mass payouts for marketplaces

- Loyalty management for clients using big data

- Factoring services based on the operation of machine learning and big data (artificially intelligent algorithms able to predict the probability of repayment of credit as well as timeliness of repayment from a company)

- Escrow services

- Mobile application with biometric identification for multi-currency transactions

Tools and services for external developers

- Opportunity to provide Forty Seven banking services under your own brand (white label)

- API access that allows the development and implementation of modern financial services based on Forty Seven infrastructure and processes

- Holding DevDays conferences for independent developers

- A showcase of financial applications using Forty Seven API

Technologies and Features

Based on the possibilities of the banking and cryptocurrency industries, we will take the best of the two spheres using innovative and proven technologies in the fields of finance, analytics, and data security.

Forty Seven Bank will provide open, flexible and well-documented API covering the majority of banking services. We will launch our own financial application platform that uses our API. By attracting clients and external developers, we plan to turn it into an efficient ecosystem with constantly growing value.

Application of smart contracts to automate financial processes, thereby enabling us to make deals and give credits with no risk of fraud. The implementation of machine learning technology will allow the creation of a personal manager to foresee all wishes of the client. A virtual interlocutor will assist in the reallocation of cash flows and will provide timely current financial information.

Biometric technologies and blockchain will enable users to open an account distantly and access it via smartphone and ATM without using a card. In combination with cryptographic encryption, these developments will provide increased security of personal and payment data.

Emission of Tokens

What is a Forty Seven Token: It’s a token that represents a part in Forty Seven Bank’s infrastructure and grants the wielder a priority place in the bank’s loyalty program. Holders of FSBT tokens have the right to receive yearly bonuses in the form of FSBL — Forty Seven Bank loyalty tokens. Besides that, FSBT tokens are a crucial economic part of Forty Seven Bank’s ecosystem — they will be needed in order to access the full range of products and services. After the crowdfunding campaign is finished, FSBT tokens will be available for trade at various cryptocurrency exchanges.

What is a token used for: 20% of the bank’s annual net profit will be invested into the loyalty program. Using smart contracts, each FSBT token holder will be able to receive their FSBL tokens based on the amount owned and afterward, exchange the FSBT tokens for different goods offered by the loyalty program (electronics, household items, airplane tickets, banking services, insurances, etc.). All FSBT token holders will receive the right to participate in Forty Seven Bank’s yearly crypto community development program and decide which projects will be supported by the bank and its shareholders.

Abbreviation : FSBT.

Control over emission: is provided by the system of interconnected smart contracts.

Rate: Fixed, value of one token — 0.0047 ETH.

Maximum amount of tokens to be generated: 11 063 829 FSBT (incl. bonus tokens, tokens for bounty and founders).

Minimum budget to start the project: 3 600 ETH (1M EUR).

Hardcap: 36 000 ETH (10M EUR).

Accepted cryptocurrencies on ICO: ETH, BTC.

ICO round 1: November 16 — December 16, 2017.

ICO round 2: December 17 — February 28, 2018.

ICO round 3: March 1 — March 31, 2018.

Token Distribution

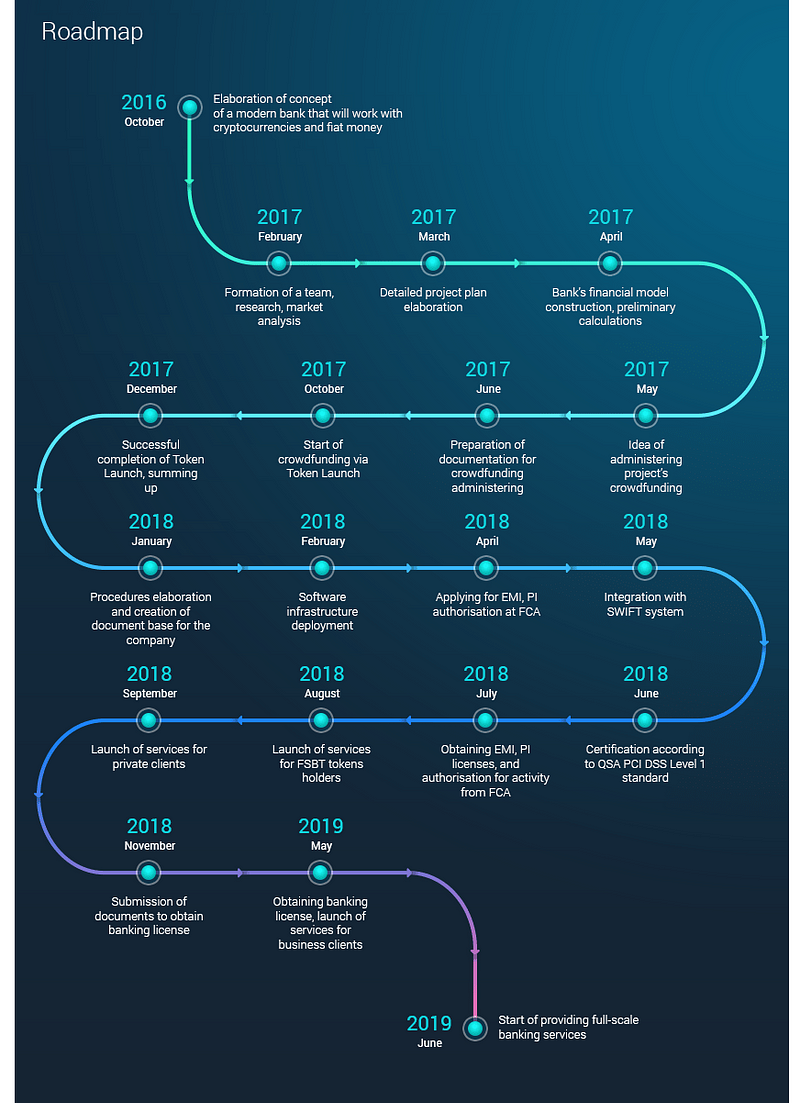

Roadmap

TEAM

Advisors

Details Information :

Website :https://www.fortyseven.io/

Twitter :https://twitter.com/47foundation

Telegram :https://t.me/thefortyseven

My Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1305006

koboysomplak

0x9F217D384D9BA25626dd81eB3529e47c6a686e26

Tidak ada komentar:

Posting Komentar